What Is A Merchant Card Advance?

FOR BUSINESSES that take payments by credit card, debit card or contactless cards this is an easy route to raise a loan even if your bank says no!

Simply put, it’s a cash injection for your business, which you pay back only as you earn, through an agreed amount of your credit & debit card sales. So it is up to you what you spend it on, and unlike a loan, there’s no APR or fixed payments. Providers usually charge a one off fee depending on the value of the loan and the risk they wish to take.

With just one simple cost which is agreed as a percentage of your takings by card, before you take the loan out, it can be a quick method of raising cash and seeing an affordable repayment plan.

Usually the repayment will be between 15% and 25% of your future card takings. What happens is the funder sets up a new bank account for all your card receipts from your card merchant – an intercepting account if you like – then payments less the loan repayment are made to your business bank account.

How much can I borrow?

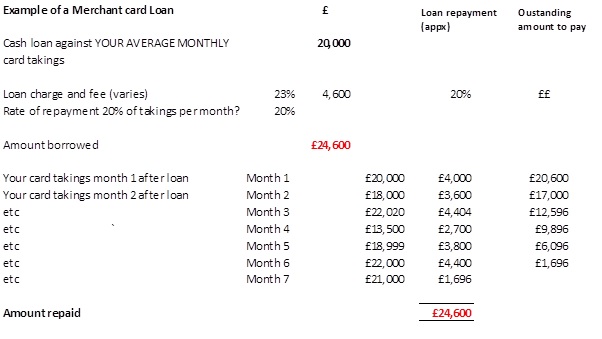

For example, if you take around £20,000 a month on card sales on average, then a loan of around 4-6 weeks’ worth of sales or £18-25,000 could be available (set by lender not you).

Then an agreed rate of repayment is set up. This can be 15-25%.

See a simple example of this type of loan below.

Whilst certainly not as cheap as a bank overdraft or bank loan, it can be quickly obtained and works well.

Advantages of a merchant card loan or advance

- Almost all trading or retail companies will be eligible for this unless they have a very poor track record.

- When you have settled the merchant cash advance, you can borrow again if further funding requirements arise.

- Can be used for cashflow issues, payment of VAT or for growth, new stock etc.

- No further security is required and once processed your account is funded within a few working days.

- There is no fixed payment – just the agreed percentage of your future card sales repays your outstanding balance.

- If you have a quiet week or month then less is repaid. If you have a really busy month then more is repaid.

- Online statements let you know the current position quickly.

- There is no security registered against the company.

Disadvantages

- This product is not suitable for start ups or those businesses that do not take card payments.

- It is not cheap as fees can be much higher than bank facilities cost. (But can you actually get a bank loan at all!)

- You will be asked to sign a personal guarantee.

- If your bank has provided secured loans it may require further information if you use a merchant card advance.