Arena Television Fraud Claims

6th December 2021GoFibre has secured £164m investment

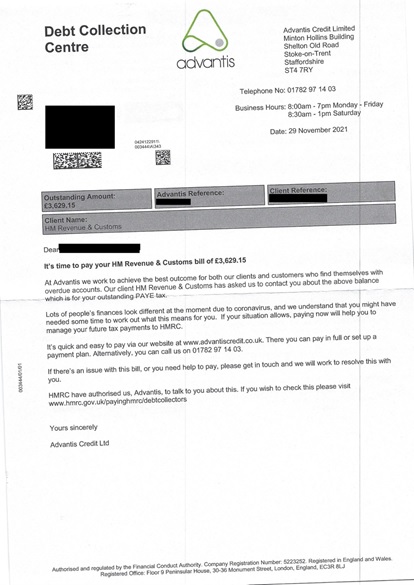

10th January 2022Have you received a debt collection letter when you have a Time To Pay (TTP) agreement with HMRC?

Recently companies have been receiving letters from debt collection agencies like Advantis on behalf of HMRC even if they have Time To Pay (TTP) arrangements in place.

HMRC has outsourced small debts to debt collection agencies. This is likely to be on a ‘no fee’ basis, with the collectors keeping a portion – e.g., 10% – of the funds that they recover.

Due to the unprecedented financial impact on businesses during 2020, HMRC temporarily halted collections activity. Now that it is recommencing, it could be possible that HMRC is prioritising larger debts internally – with collections agencies taking charge of debts smaller than £5,000 or even £10,000.

What if I already have a TTP agreement in place with HMRC?

If you already have a TTP agreement in place with the tax office and you’re keeping up with payments, then you don’t need to worry. The letters appear to be a ‘one size fits all’ document, and WE BELIEVE no action will be taken if you don’t respond to it. BUT BEST TO MAKE CONTACT TO TELL THEM YOUR TTP IS UP TO DATE

What if I can’t afford to make the payments?

If you’re struggling to make your TTP payments, it’s worth contacting HMRC directly to discuss this.

If you believe that your company is still viable, and you’re unable to adjust your TTP agreement, then there may be alternative funding options available to you. Find out more about the types of finance available here.

If you’d like to discuss the right funding option for your company, or if you have any questions, please don’t hesitate to give us a call on 020 7760 7524.